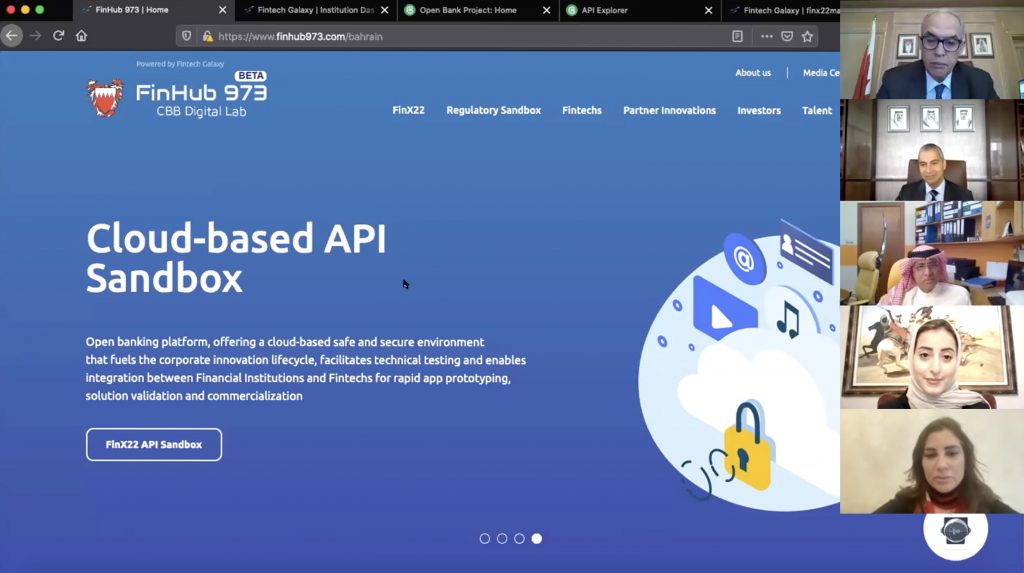

Manama, Kingdom of Bahrain – 6 March 2021 – The Central Bank of Bahrain (“CBB”), in cooperation with the Bahrain Association of Banks (“BAB”), held a forum for banks and insurance companies regarding FinHub973 to discuss the progress of the platform which was launched in October 2020 in cooperation with Fintech Galaxy.

The virtual forum was attended by Mr. Rasheed Mohammed AlMaraj, Governor of the CBB, Dr. Waheed Al Qassim, CEO of BAB, Mr. Khalid Humaidan, Chief Executive of the Bahrain Economic Development Board (EDB), and CEOs of retail banks and insurance companies.

FinHub 973 is the MENA region’s first cross-border digital innovation platform that connects and facilitates collaboration between financial institutions and FinTechs under the supervision of the central bank. FinHub973 enables local and global FinTechs to connect seamlessly with Bahrain’s financial institutions to explore, test, and prototype new and innovative solutions on a centralized digital sandbox.

During the forum, the latest developments in FinHUb 973 were presented, most notably the open API Sandbox, which will enable banks and other financial institutions in Bahrain to seamlessly integrate with FinTechs to support them on their digital transformation journeys. A new feature of the platform was also highlighted, namely providing compliance as a service for partner banks and financial institutions with Bahrain Open Banking Framework.

On this occasion, Mr. Rasheed Al Maraj, Governor of the CBB said: “This initiative is an opportunity to stimulate innovation opportunities and enhance cooperation between the CBB, financial instituions and FinTechs to explore and create new and innovative solutions through a centralized virtual environment. Such an initiative supports seamless transition towards digital banking as part of our continuous digital transformation strategy for the financial sector in the Kingdom”. Mr. Al Maraj encouraged financial institutions to participate in this platform and benefit from the opportunities resulting from collaberating with FinTechs.

Dr. Waheed Al-Qassem, CEO of BAB, said: “This smart initiative by the CBB will boost the development of financial technology and provide the necessary support for incubation, guidance and financing of FinTechs, and enhance this field within the financial sector and wider economy in line with the Bahrain Economic Vision 2030”.

Dr. Al Qassim added: “FinHub 973 become a comprehensive benchmark for the development of financial technology in Bahrain, based on the shared focus and talent provided by the partner financial institutions and stakeholders of the platform.” Dr. Al Qassim expects this platform to achieve more success, especially as financial technology is an essential part of digital transformation in the Kingdom of Bahrain, and the need to adopt this new technology by the public.