Under Articles 44 to 47 of the Central Bank of Bahrain and Financial Institutions Law 2006 (‘CBB Law’), the application process is a single phase process with the CBB required to take a decision within 60 calendar days of an application being deemed complete (i.e. containing all required information and documents). The application itself consists of a completed Form 1 (Application for a License), together with all supporting documentation as specified in the Licensing Section of the relevant Module LR or AU, under cover of a letter signed by an authorised signatory of the applicant.

Once the application has been submitted and reviewed by the CBB’s licensing committee, the CBB may provide an initial ‘in principle’ confirmation that the application has been reviewed and the applicant may proceed to the next stage of the licensing process whereby remaining information and documents (a schedule of which will be attached to the letter) must be submitted in order to proceed.

Such a confirmation does not constitute a license approval, nor does it commit the CBB to issuing a license. Note also that no confirmation will be issued unless certain key pieces of information, such as the proposed Board members and shareholder controllers, are included in the license application. Further details on these required pieces of information are included in the Rulebook.

Applicants must not on any account either hold themselves out as being licensed, or undertake any regulated services, until after their formal application has been submitted and fully approved. A breach of this rule may, of itself, constitute grounds for refusing the application. It is also a contravention of the CBB Law (cf. Articles 40 and 41), which carries a maximum penalty of BD 1 million.

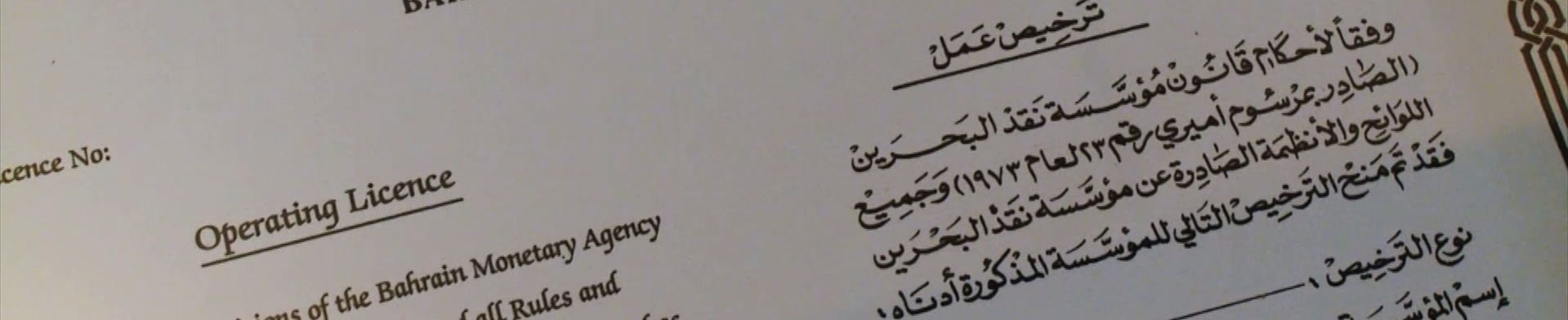

License applications are reviewed for compliance with the relevant licensing conditions, as specified in the CBB Rulebook, together with the specified information and documentation required. If a license is granted, the CBB will notify the applicant of the fact in writing, and is also obliged to publish the fact in the Official Gazette. The license may subject to such terms and conditions as the CBB believes necessary, and will in all cases list the specific regulated services for which approval has been granted. In instances where an application is rejected, the CBB will notify the applicant in writing, stating clearly the reason for rejection.