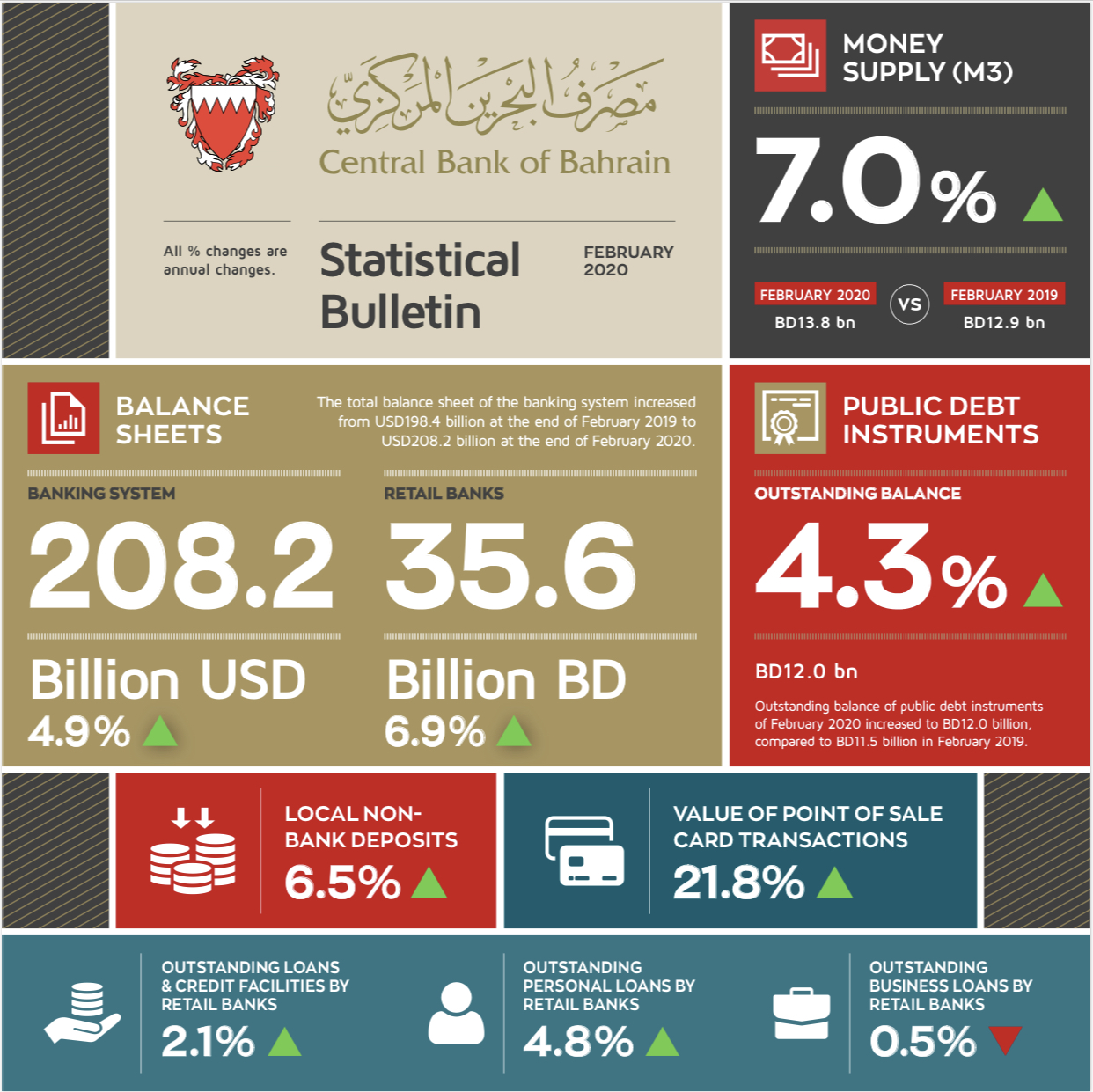

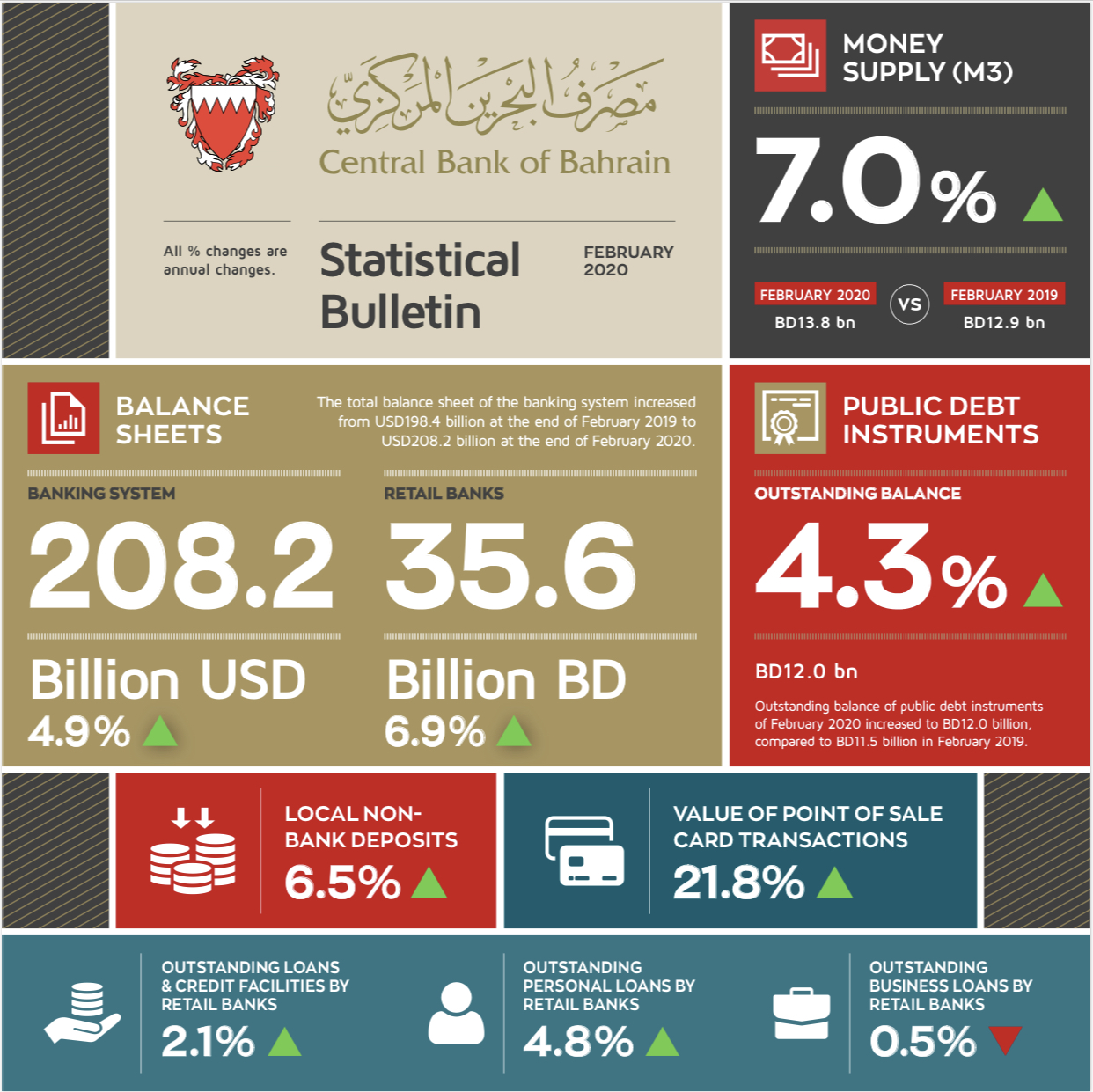

Manama, Bahrain, 7 April 2020 – The Central Bank of Bahrain (CBB) monthly statistical bulletin for February 2020 indicated an overall improvement in monetary and banking indicators compared to the same period-end of last year. Money supply (M3) increased significantly, reaching BD13,8 billion as at end of February 2020, compared to BD12,9 billion as at the same period-end last year, an increase of 7.0%. In addition, total outstanding balance of public debt instruments which includes Development Bonds, Treasury Bills, Islamic Leasing securities and Al Salam Islamic securities increased at the end of February 2020 to BD12,0 billion, compared to BD11,5 billion in February 2019.

The data also indicated an increase in the total balance sheet of the banking system from USD 198.4 billion at the end of February 2019 to USD 208.2 billion at the end of February 2020, a significant increase of BD9.8 billion, or 4.9%, in the 12-month period.

The balance sheet of retail banks increased by BD2.3billion, or 6.9%, reaching a total of BD35.6 billion at the end of February 2020 compared to BD33.3 billion as at end of February 2019. The data also shows an increase in local non-bank deposits which amounted to BD 13.2 billion at the end of February 2020 compared to BD12.4 billion at the end of February 2019, an increase of 6.5%.

The total value of outstanding loans and credit facilities provided by retail banks amounted to BD9,8 billion at end of February 2020 compared to BD 9,6 billion at the end of February 2019, an increase of 2.1%. This amount includes loans and facilities provided to the personal sector amounting to BD4,4 billion at the end of February 2020 compared to BD4,2 billion at the end of the same period last year.

The data indicates that credit card and debit card transactions across Point of Sales (POS) terminals amounted to BD205.7 million in February 2020 compared to BD168.8 million in February 2019; marking a significant increase of BD36.9 million or 21.8%.